What is a Balance Transfer?

Balance transfers can be a great way for a cardholder to refinance and pay off existing high interest debt with a temporary lower interest rate often 0% or less than the cardholders existing credit card interest rate. But make sure you understand how balance transfers work before you apply. In this article we will walk you through what balance transfers are all about.

Key Takeaway

- Think of 0% interest rate balance transfer a no interest loan for the introductory period.

- Balance transfer means you are transferring debt from one card to another credit card as way to manage high interest credit card.

- You have to commit to a monthly payment plan to make the best use of the balance transfer card.

Definition of a Balance Transfer Credit Card

A balance transfer credit card is a type of credit card that allows you to transfer the balance from one or more existing cards to a new card with a lower interest rate. This can help you save money on interest charges and pay off your debt faster. Credit card providers encourage consumers by offering a temporary 0% interest rate or a lower interest rate than the existing credit card. A balance transfer credit card may also offer other benefits, such as rewards, cash back, or introductory offers. However, there are some drawbacks and risks to consider before applying for a balance transfer credit card, such as fees, credit score impact, and debt management.

How a Balance Transfer Credit Card Works

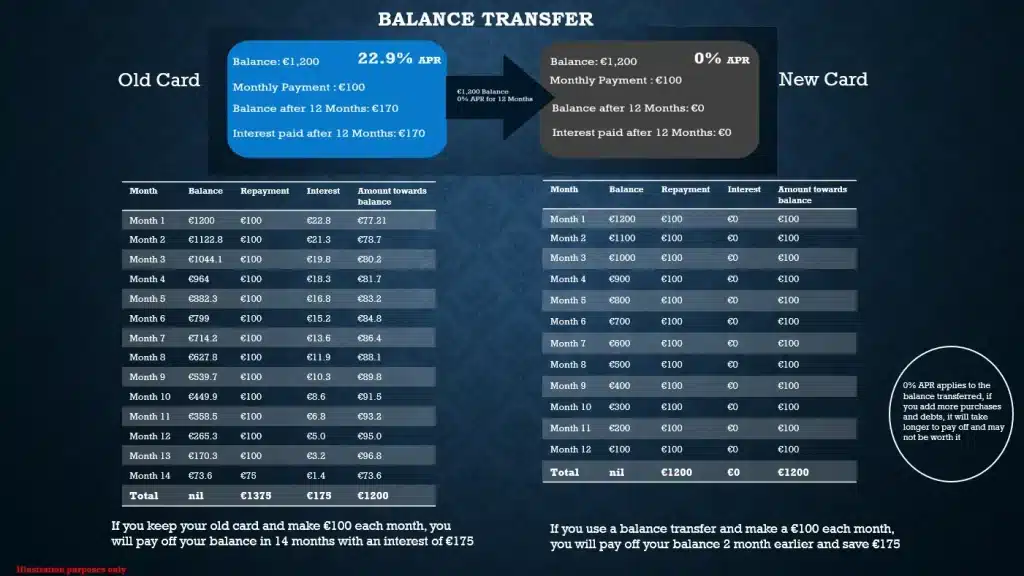

A balance transfer involves paying off one credit card with another at a lower interest rate. The simple illustration above shows how a balance transfer works:

Assuming you currently have a €1,200 credit card balance with a 22.9% APR. Monthly payment of €100 will mean that you will pay off your balance in a longer than 12 month period due to interest, so you decide to open a credit card with a 0% APR on balance transfers for 12 months. Once the new credit card is approved and you are given a credit card limit above €1,200, you can provide the new card issuer with your card details and the card issuer will handle the balance transfer. Once the balance transfer is complete, you’ll start making payments to the new credit card issuer.

**If you make additional purchases on this card, depending on the card type the standard interest rate for the card applies. So the outstanding credit card balance would be composed of a portion accruing interest at a promotional interest rate and a portion accruing interest at the regular purchase interest rate**.

Elements of a Balance Transfer Credit

- Introductory Rate on Balance Transfer: This is a special fixed interest rate of 0% on balance transfers for first 3,6,or 12 months of account opening (depending on credit card provider offer).

- Introductory period: The period that the special rates is on offer. The period starts from account opening date, not the date the card is first used to purchase.

- Standard interest rate of the card: This is the variable interest rate of the card after the promotional period.

Pros and Cons of a Balance Transfer Credit Card

Pros:

- Save money on interest paid when you move your debts from a high interest credit to a lower interest credit card.

- You can pay off your credit card balance within a shorter time period because you spend less time paying interest.

Cons:

- The interest rate is temporary, so you will need to make sure your repayments are enough to clear your debts in the promotional period.

- Your existing balance may be more than your new credit card limit, this means you may have to pay the difference in a higher interest rate.

- If you miss your repayment, the credit card provider may withdraw your promotional interest rate and the balance begins to accumulate interest at the regular card rate.

How Banks make money on balance transfer card

When an issuer extends a balance transfer credit card offer, it’s hoping you won’t pay off your balance in the intro period. Even better for the issuers, they hopes you’ll keep spending and accrue high interest on those purchases.

Following on from the above example, if you make additional purchases of €1,000 and you continued making €100 payments after the introductory rate expires, you’d spend additional amount on interest accrued on the €1000, which is good enough reason for a bank to offer 0% APR for 12 months

Examples of a Balance Transfer Credit Card in Ireland

BOI Platinum Advantage Card

Annual Fee €76.18

Introductory Offer: 0% fixed interest on purchases for first 6 months or 0% fixed interest on balance transfers for first 7 months!

APR: 19.6% Variable

One Credit card

Annual Fee

€0

Intro Offer:0% on purchases for 3 months and balance transfers for 9 months. €150 cash back.

APR: 22.9% Variable

An Post Classic Credit Card

Annual Fee

€0

Intro Offer: 0% fixed interest on balance transfers for 12 months.

APR: 22.9% Variable

>>Learn More: Best Balance Transfer Credit Cards in Ireland

Alternatives to a Balance Transfer Credit

Personal Loan

Personal loan interest rates are much lower than credit cards and can be a good alternative to balance transfer credit card to offset an existing high interest credit card or debt. You can pay off multiple credit card balances with a personal loan and consolidate into a single monthly payment.

Money Transfer Credit Card

It’s a credit card that allows you to transfer money from your credit card directly into your bank account. Some credit card issuers may have to pay interest on the money borrowed and there could be a fee for the transaction but money transfer credit cards in Ireland don’t charge for the transfer. You may want to check with the issuer on the maximum amount that you can transfer from your credit card. You can use the money transferred to clear off existing high interest debt using a low interest. Avant Money One Card is an example of money transfer credit card and the card offers 0% interest rate on money transfers for 12 months.

Frequently Asked Questions

Do all Credit cards allow balance transfers?

No not all credit cards offer balance transfer option or 0% balance transfer for a temporary period. Some credit cards may offer a lower rate for balance transfers.

Can you pay off a credit card with another credit card

Yes, the purpose of a balance transfer option is to give you the option of paying off your existing high interest credit card balance with a lower interest credit card.

Should you get a second balance transfer credit card

You may not get approved two balance transfer cards from one credit card issuer. If your current balance transfer credit card does not cover your existing debt, you may want to consider another credit card to transfer the remaining balance in order to clear off your debt. You must be aware of the downside and risk of not committing to making your monthly payment to cover off your debt during the free interest period. It has a potential of ruining your credit and ability to take credit in the future.

Final Thoughts

Don’t waste your monthly payment on interest. Take full advantage of a balance transfer credit card but you must commit to paying off your full balance within the card’s intro period to make an effective use of the card. Making additional purchases and adding more debts to the card, may take you back and deep into debt.

Lynda Unogu MBA IMC (CFA UK) PMP

Lynda holds an MBA from University College Dublin and worked previously in product roles within financial services and technology firms like Mastercard, Citi Bank and JP Morgan. She constantly seeks to apply her expertise in financial services to the field of personal finance with the goal of helping people navigate the complexities of the finance.