Analysing High Credit Card Interest Rates in Ireland

High credit card interest rates in Ireland have become a hot topic lately. Despite efforts to cap rates, many consumers are still paying way above the legal limit.

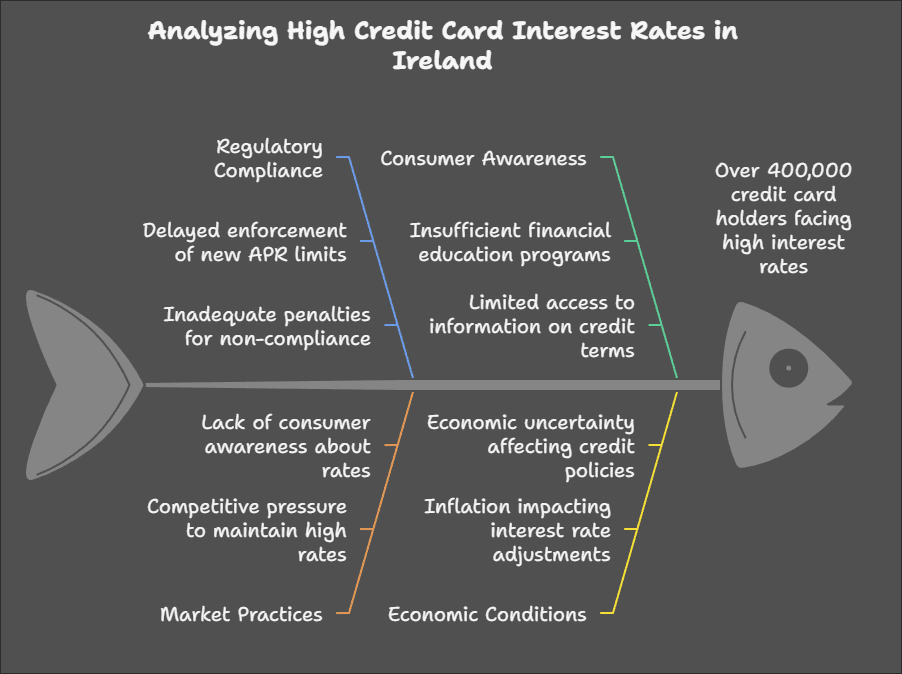

In recent years, the issue of high credit card interest rates in Ireland has become a significant concern for both consumers and regulators. Despite efforts to cap annual percentage rates (APRs) at 23%, a substantial portion of credit card holders continue to pay rates well above this threshold. This article delves into the various factors contributing to this situation, including regulatory compliance, consumer awareness, market practices, and economic conditions.

Regulatory Compliance

One of the primary issues is the delayed enforcement of new APR limits. Although the Central Bank of Ireland mandated that new credit card accounts should not exceed an APR of 23% since 2022, the implementation has been sluggish. As a result, over 400,000 credit card holders are still subjected to interest rates as high as 27.9%1. This delay in enforcement has allowed financial institutions to continue charging exorbitant rates without facing significant repercussions.

Moreover, the penalties for non-compliance have been inadequate. The Central Bank’s review highlighted that banks and lenders have made minimal efforts to inform customers about the availability of lower-rate products2. This lack of proactive engagement indicates a failure to act in the best interests of consumers, further exacerbating the issue.

Consumer Awareness

Another critical factor is the insufficient financial education programs available to consumers. Many credit card holders are unaware of the high rates they are being charged and the options available to them. The complexity of interest charges on credit cards and the lack of effective disclosures contribute to this lack of awareness. Additionally, limited access to information on credit terms makes it challenging for consumers to make informed decisions.

The Central Bank has urged lenders to address these issues by providing better assistance and communication to customers. By enhancing financial education programs and ensuring that consumers have access to clear and concise information, it is possible to improve consumer awareness and empower individuals to make better financial choices.

Market Practices

Market practices also play a significant role in maintaining high credit card interest rates. Competitive pressure among financial institutions often leads to a reluctance to lower rates, as banks fear losing profitability. This competitive environment creates a situation where high rates are sustained, despite regulatory efforts to cap them.

Furthermore, the lack of consumer awareness about rates allows banks to continue charging high interest without facing significant backlash. The Central Bank’s findings indicate that banks have not made sufficient efforts to inform customers about lower-rate products. This lack of transparency and proactive engagement perpetuates the cycle of high interest rates.

Economic Conditions

Economic conditions in Ireland have also influenced credit card interest rates. Economic uncertainty, driven by factors such as Brexit and global market fluctuations, has led to cautious credit policies among financial institutions. Banks are more likely to maintain high interest rates to mitigate potential risks associated with economic instability.

Inflation is another factor impacting interest rate adjustments. As the cost of living rises, banks adjust their rates to maintain profitability. This adjustment often results in higher interest rates for consumers, further burdening those already struggling with financial challenges.

Conclusion

The issue of high credit card interest rates in Ireland is multifaceted, involving regulatory compliance, consumer awareness, market practices, and economic conditions. Addressing this problem requires a concerted effort from regulators, financial institutions, and consumers. By enforcing APR limits more effectively, enhancing financial education programs, promoting transparency, and considering the broader economic context, it is possible to alleviate the financial burden on Irish credit card holders and create a fairer and more equitable financial landscape.