Bank of Ireland Affinity Credit Card Review: 2.9% Balance Transfer Card that also Supports Your Alumni While You Spend

Owning a Bank of Ireland Affinity Credit Card is an opportunity for cardholders to support their alumni while spending and it is also a low interest rate balance transfer card

Disclosure

We have compiled these resources without taking into account your personal objectives, circumstances, financial situation or needs. Therefore, before acting on any information contained on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. You can read the full Terms of Use.

Summary:

Get this 2.9% interest rate on balance transfer and also support your college while you spend.

Pros:

- 2.9% fixed interest on balance transfers for first 12 months

- Making donations to your college when you own a cardholder and additional payment of donation every year without affecting your budget

- No transaction fee

- No annual fees

- Low cost instalment option

- Free additional cardholders for up to 3 holders

- Offers and experience from Mastercard Priceless

Cons:

- Donations are usually very small

- The donations are not tax deductible

- No 0% interest rate offer

- If partnership ends, the card run a risk of cancellation

Affinity Credit Card

- Monthly Fee: €0

- Intro Offer: 2.9% fixed interest rate on balance transfers for 12 months

- Interest Rate: 14.57% variable on all purchases

- APR: 20.2% variable

- Currency Conversion Fee (POS/ATM): 2.25%

- Stamp Duty: €30 annually

- Balance Transfer: 2.9% on balance transfers for 12months

- Additional Card Fee: €0

- Late Payment Fee: €7.50

- Cash Advance Fee: 1.5%

Bank of Ireland Affinity Credit Card Product Details

- Card Offer: 2.9% fixed interest on balance transfers for first 12 months

- Exclusive offers and experiences: Bank of Ireland affinity credit card is on Mastercard payment network and will get access to exclusive experiences, offers and benefits in Ireland or when exploring other destinations abroad with MasterCard Priceless Cities.

- Annual fee of €0 and €30 Government stamp duty.

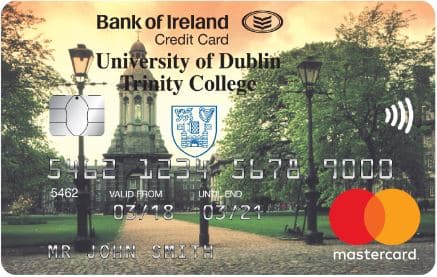

- College Donation – When you become an affinity card holder, the bank makes a donation to your college on your behalf and additional payment to your University’s alumni fund for each year your Affinity card is active. You also get your college branded credit card.

- Instalment option at a low cost: Spread the cost of larger purchases at low interest rate using Mastercard credit card Instalment Plan.

- Free Additional Cardholders: Add up to 3 additional cardholders and pay government stamp duty only once.

View Fees and Rates

Compare Similar Credit Cards

BOI Affinity Credit Card

Annual Fee €0

Introductory Offer: 2.9% fixed interest on balance transfers for first 12 months

APR: 20.2% Variable

One Credit Card

Annual Fee

€0

Intro Offer:0% on purchases for 3 months and balance transfers for 9 months

APR: 22.9% Variable

AIB Platinum Card

Annual Fee

€0

Intro Offer: Spend over €5,000 and up to €50,000 for a 0.5% of that amount back max is €225 per year. Offers premium benefits with no annual fees.

APR: 17% Variable

What are the Benefits and Perks of Affinity Credit Card?

Card type: Balance transfer card

Annual fee: The Bank of Ireland Affinity Credit Card charges €0.

Intro Offer Interest Rate: 2.9% fixed interest on balance transfers for first 12 months. At the end of the introductory period the annual interest rates revert back to the standard variable purchase rate applicable to your card at that time.

» MORE: Best Balance Transfer Credit Cards

College Donations – We make a donation when you become an affinity cardholder, as well as donating an additional payment to your University’s alumni fund for each year your Affinity card is active. You also receive your college branded credit card.

Ongoing rewards: Access to exclusive experiences, offers and benefits in Ireland or when exploring other destinations abroad through Mastercard Priceless

» MORE: What to expect from Mastercard Priceless

Free Additional Cardholders: Add up to 3 additional cardholders and still pay government stamp duty only once.

Foreign transaction fees: No transaction fee on Euro transaction and 2.25% on non euro transaction

You Might Want To Consider a Different Credit Card

No 0% Intro Interest Rate on Balance Transfer and Purchases: The affinity credit cards offers 2.9% interest rate on balance transfers for 12 months but if you are looking for a balance transfer card with a 0% interest rate, this card is not for you. Avant Money One Card is your best alternative. You pay no interest on balance transferred from existing cards for 9 months. In addition you get 0% interest rate on purchases for 3 months.

Other Credit Cards offer Cash Back : AIB Platinum Visa Card has no annual fee and you can earn 0.5% cash back of £225 in each 12 months you can decide to pair them with this card if you make large purchases yearly and will benefit from Cash Back.

See our Coins to Asset Best Credit Cards in Ireland reviews to compare with other cards.

What is an Affinity Credit Card

An affinity credit card is a card created from partnership between a bank and a non profit organisation such as a college or university, charities, non profit sport clubs and academic groups. The bank or financial institution uses an affinity credit card as a monetary incentive to the organisation. The Affinity credit card is usually linked to a charity organisation or non- profit and will carry the logo of the organisation. So every time a credit card is opened and actively used, a donation is made to the non profit organisation.

Bank of Ireland offers affinity cards to a selection of different university that they support.

How Affinity Card Works?

Affinity credit cards is akin to co-branded credit cards in that two organizations, a financial institution and a brand, but in this case it is between a financial institution and a non profit. Affinity cards that support a non-profit university’s alumni association are common. For example the UCD affinity credit card was created to exclusively for alumni, supporters, and friends and staff of UCD and specifically to use the donations it gets from the affinity, to support development fund, UCD Champions Access Scholarships and UCD Alumni Fund. UCD Alumni's are motivated and see this as an opportunity to support their college through donations that don't cost them directly. These partnerships provides publicity for the university and provides increased visibility and awareness for its causes.

Affinity Credit Card Examples

Review Methodology

Coins to Asset reviews credit card across many the factors. We analysed popular 14 credit cards available in Ireland to come up with the best cards for you. We looked at fees, interest rates, rewards and cash backs including the ease of redeeming the rewards. We also considered the monetary value of the benefits and perks and the overall value add of the card to the cardholder. Part of our review includes ease of credit card application, the simple reward structure, attractiveness of the features, and whether the card suits everyday use or best reserved for specific purchases. We give star ratings serve as a general guide of our comparison but it is only a consideration when you are choosing a credit card not a rule. Learn how Coins to Asset Rates Credit Cards.

Lynda Unogu MBA IMC (CFA UK) PMP

Lynda holds an MBA from University College Dublin and worked previously in product roles within financial services and technology firms like Mastercard, Citi Bank and JP Morgan. She constantly seeks to apply her expertise in financial services to the field of personal finance with the goal of helping people navigate the complexities of the finance.