How ECB Affects Mortgage Rates

The European Central Bank (ECB) plays a crucial role in shaping the economic landscape of the eurozone, which also includes Ireland. ECB policies and decisions have a significant influence on mortgage rates, influencing the cost of borrowing for homeowners in Ireland. We will explore the relationship between the ECB and mortgage rates in Ireland, look at the roles of the ECB and the Central Bank of Ireland, the interplay between mortgage rates and inflation, and historical trends.

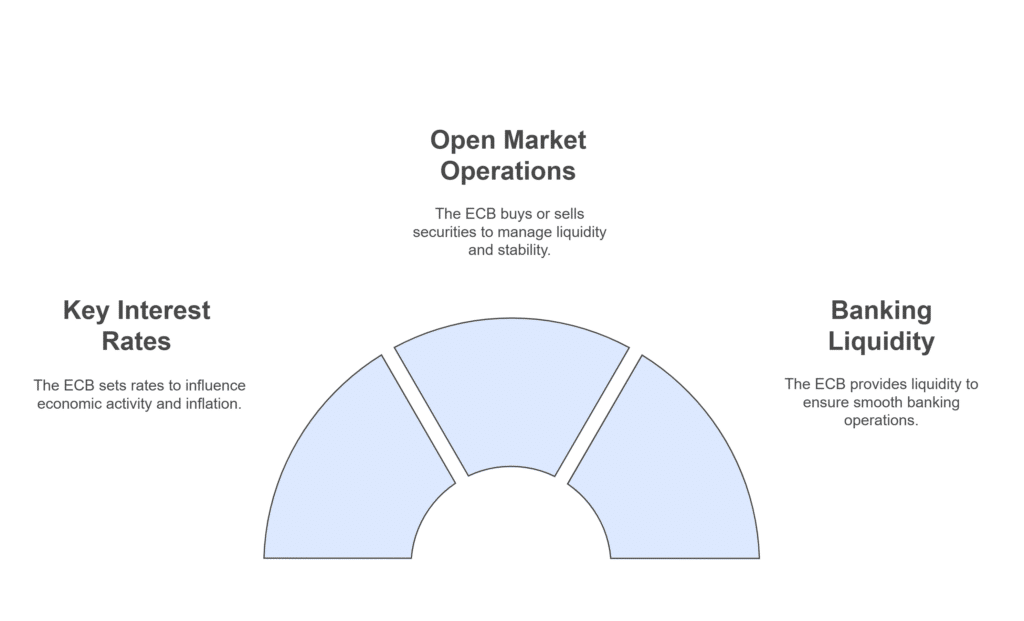

What the ECB Does?

The ECB is regarded as the central bank for the eurozone, responsible for managing the euro and formulating monetary policy to maintain price stability. Its primary tools include setting key interest rates, conducting open market operations, and providing liquidity to the banking system. The ECB’s main objective is to keep inflation close to, but below, 2% over the medium term. By adjusting interest rates, the ECB influences borrowing costs, consumer spending, and overall economic activity.

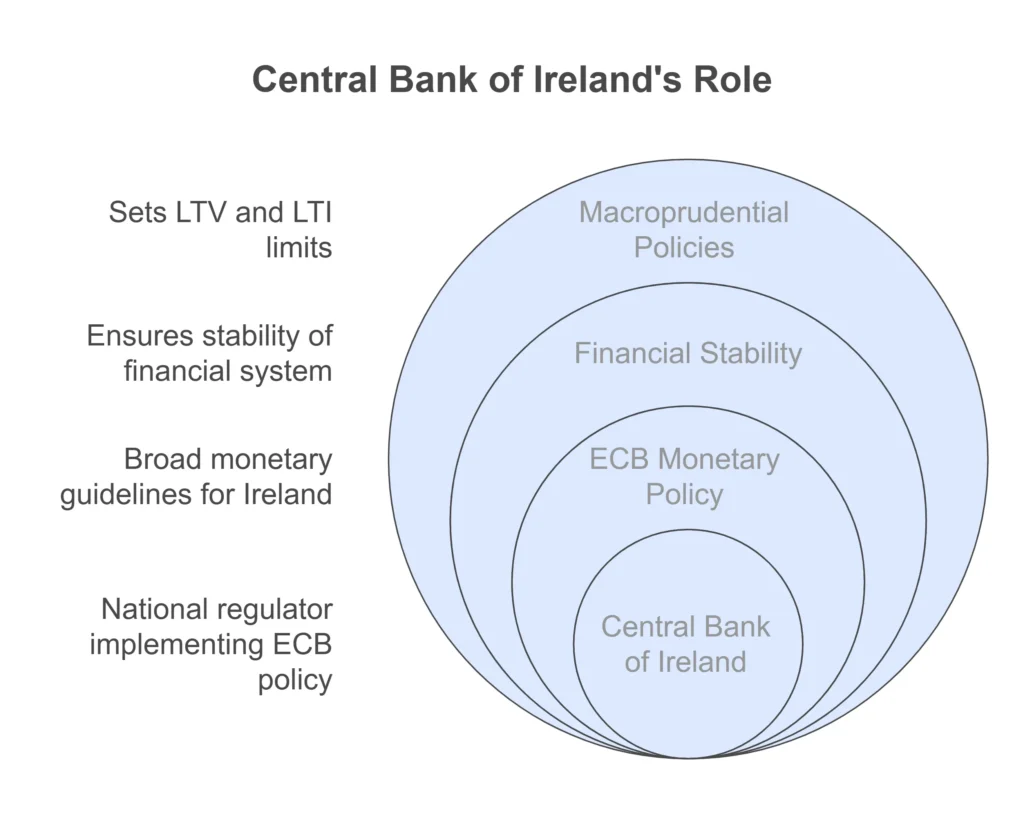

What the Central Bank of Ireland Does?

The Central Bank of Ireland is the national central bank and financial regulator. It implements the ECB’s monetary policy at the national level and oversees the stability of the Irish financial system. The Central Bank of Ireland also sets macroprudential policies, such as loan-to-value (LTV) and loan-to-income (LTI) limits, to ensure sustainable lending practices and prevent financial imbalances.

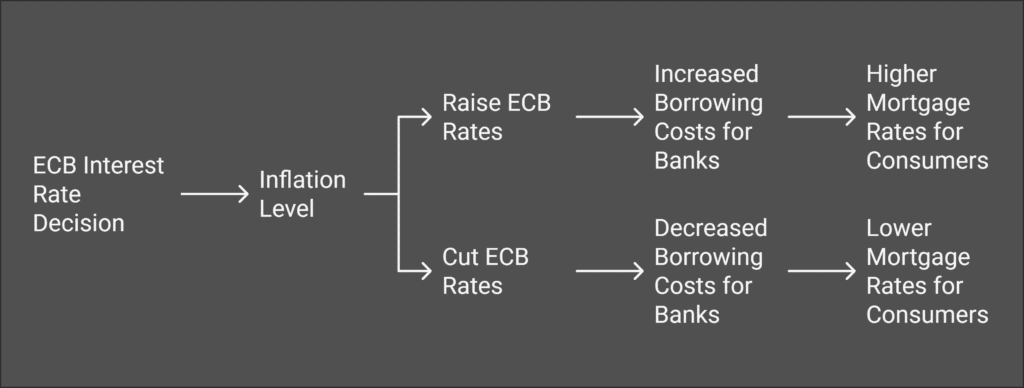

The ECB, Mortgage Rates, and Inflation

Mortgage rates in Ireland are influenced by the ECB’s interest rate decisions. When the ECB raises its key interest rates, borrowing costs for banks increase, leading to higher mortgage rates for consumers. Conversely, when the ECB cuts rates, borrowing costs decrease, resulting in lower mortgage rates. Inflation plays a critical role in this dynamic. If inflation is high, the ECB may raise rates to cool down the economy. If inflation is low, the ECB may cut rates to stimulate economic activity.

Do Mortgage Rates Follow ECB Rates?

Mortgage rates in Ireland generally follow the ECB’s interest rate changes, but the relationship is not always direct or the impact, immediate. Banks consider various factors, including their own funding costs, competitive pressures, and risk assessments, when setting mortgage rates. As a result, changes in ECB rates may take time to fully reflect in mortgage rates. Additionally, fixed-rate mortgages may not be immediately affected by ECB rate changes, while variable-rate and tracker mortgages are more sensitive to such adjustments.

Historical ECB Rates vs Irish Mortgage Rates

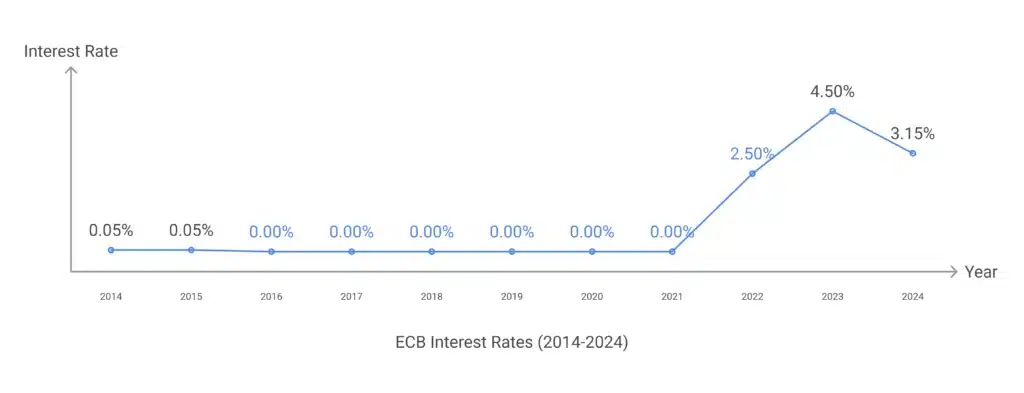

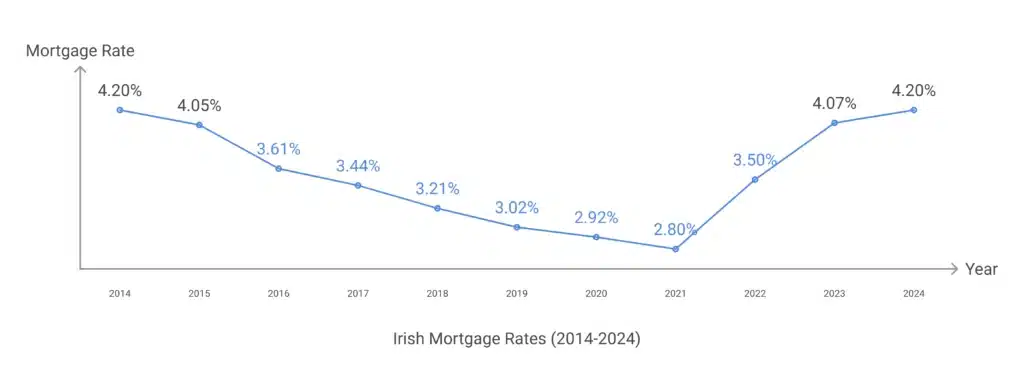

Historically, the ECB’s interest rate decisions have had a significant impact on Irish mortgage rates. For example, during the financial crisis of 2008, the ECB cut rates to historic lows to support the economy, leading to lower mortgage rates in Ireland. More recently, the ECB has implemented several rate cuts in response to moderating inflation and economic challenges, resulting in lower mortgage rates for Irish borrowers. Here we look at the ECB interest rates vs Mortgage rates in Ireland for the past 10 years.

Impact of ECB Rate Changes on Mortgage Rates

2014-2021: Low and Stable ECB Rates

- During this period, the ECB maintained very low interest rates, with the main refinancing rate at 0.05% from 2014 to 2015 and 0.00% from 2016 to 2021.

- Irish mortgage rates gradually decreased, reflecting the low cost of borrowing. Mortgage rates fell from 4.20% in 2014 to 2.80% in 2021.

2022: Sharp Increase in ECB Rates

- In 2022, the ECB raised its main refinancing rate to 2.50% in response to rising inflation.

- This led to an increase in Irish mortgage rates, which rose to 3.50% in 2022.

2023: Continued Increase in ECB Rates

- The ECB continued to raise rates, reaching 4.50% in 2023.

- Correspondingly, Irish mortgage rates increased to 4.07% in 2023.

2024: Slight Decrease in ECB Rates

- In 2024, the ECB reduced its main refinancing rate to 3.15%.

- Irish mortgage rates remained relatively high at 4.20%, reflecting the lag in adjustment and the cautious approach of lenders.

Final Thoughts

The data clearly shows that changes in the ECB’s main refinancing rate have a direct impact on Irish mortgage rates. When the ECB maintains low rates, Irish mortgage rates tend to decrease, making borrowing more affordable for consumers. Conversely, when the ECB raises rates to combat inflation, Irish mortgage rates increase, leading to higher borrowing costs. The ECB’s monetary policy decisions play a vital role in shaping mortgage rates in Ireland. Understanding this relationship helps borrowers make informed decisions about their mortgages and navigate the complexities of the financial landscape.

How have the recent ECB rate changes impacted your mortgage? If you have a mortgage, check with your bank to see if your rates have changed or are expected to change soon due to the latest ECB rate cut announcements.