Overview of Bank Account Fees and Charges in Ireland

A recent survey reveals that nearly three-quarters of Irish consumers believe bank fees for basic services are excessively high. This dissatisfaction highlights the need for better understanding and management of these fees.

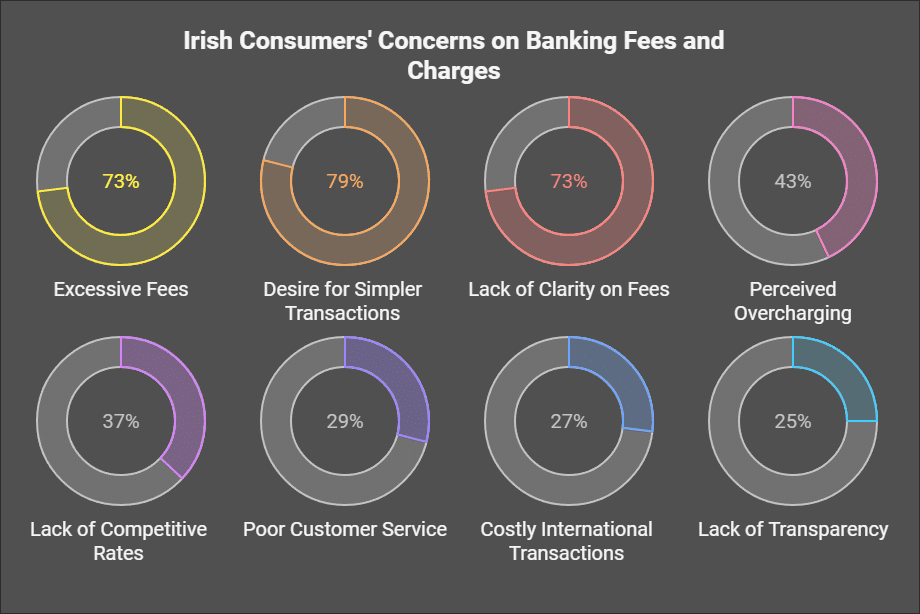

Consumers Concerns on Bank Account Fees and Charges

The survey conducted by Censuswide for the money app Wise reveals that nearly three-quarters of Irish consumers believe bank fees for basic services are excessively high. Specifically, 73% of respondents feel that charges for services such as account maintenance and ATM withdrawals are too steep. Additionally, 79% of those surveyed expressed a desire for banks to simplify the process of transferring and spending money abroad. The survey also highlights that 43% of consumers felt overcharged by hidden exchange rate fees in the past year. These findings underscore a significant dissatisfaction among Irish consumers regarding the transparency and fairness of bank fees.

Whether you’re tired of paying high bank fees or are learning about these fees for the first time, knowing why they exist and how to avoid them can put your money back where it belongs — your account.

What Are Bank Account Fees?

Bank account fees are charges that banks apply for maintaining and managing your account. These fees can vary depending on the type of account and the bank you choose. Let’s break them down:

Account Maintenance Fee

This is a fee for keeping your account open and active. It’s usually charged quarterly. For example, AIB charges €4.50 per quarter for maintaining a standard current account.

Transaction Fees

These fees apply to various transactions you make with your account. They can include:

- Automated Transactions: Such as debit card purchases, standing orders, and direct debits. These typically cost around €0.20 each.

- Self-Service Transactions: Like ATM withdrawals, which can cost about €0.35 each.

- Paper/Staff Assisted Transactions: Including cheques and in-branch withdrawals, usually costing around €0.39 each.

What Are Service Charges?

Service charges cover a wide range of additional services provided by banks. Here are some common ones:

- Duplicate Bank Statements – Need an extra copy of your bank statement? That’ll cost you around €3.00 per page.

- Unpaid Charges – If a cheque or direct debit is returned unpaid due to insufficient funds, you might be charged around €10.00 per item.

- Standing Orders – Setting up or amending a standing order manually can cost you €4.50 and €2.50, respectively.

Overdraft Borrowing Charges

Overdrafts can be a lifesaver in a pinch, but they come with their own set of charges:

- Facility Fee – This is an annual fee for having an overdraft facility. For example, AIB charges €25.39 per year.

- Interest – You’ll pay interest on the amount you overdraw. The rate varies by bank and account type, so it’s best to check with your bank for specific rates.

- Unauthorised Overdraft Charges – If you exceed your overdraft limit without authorization, you might incur additional charges. For instance, AIB charges €5.15 per item for referral items.

What Are Government Charges?

Certain charges are mandated by the government and collected by banks:

- Stamp Duty on Cheques – Each cheque you write incurs a stamp duty of €0.50.

- Stamp Duty on Debit Card – This is charged at a rate of €0.12 per ATM transaction, capped at €2.50 if you only use your card for ATM transactions, and €5 if you use it for both purchases and ATM transactions.

Card Usage Abroad

Using your debit or credit card abroad can incur additional fees. Here’s what you need to know:

- Currency Conversion Fees – When you use your debit card for purchases in a foreign currency, a currency conversion fee is applied. For example, AIB charges 1.75% of the euro value, with a minimum fee of €0.45 and a maximum of €11.00.

- Cash Withdrawal Fees – Withdrawing cash from an ATM abroad can also attract fees. AIB charges a commission of 2.5% of the euro value, plus a cash withdrawal commission of 1% of the euro value, with a minimum fee of €2.00 and a maximum of €6.00.

Fund Transfers

Transferring funds, especially internationally, can come with its own set of fees:

- Domestic Transfers – Inter-branch transfers typically cost around €19.05, while inter-bank transfers can be around €25.35.

- International Transfers – For international transfers, fees can vary. For example, Bank of Ireland charges €0.50 for euro transfers within the EEA, but other international transfers can incur higher fees depending on the destination and currency.

Foreign Exchange Charges

When dealing with foreign currencies, banks often apply additional charges:

Currency Conversion – Banks charge a margin on the currency conversion rate. For example, Bank of Ireland applies a 1% fee on the transaction value for foreign currency cash transactions, with a minimum fee of €1.25 and a maximum of €6.35.

How to Avoid Bank Fees in Ireland

Given the widespread dissatisfaction with high bank fees among Irish consumers, here are some steps you can take to manage your finances more effectively:

- Explore Digital-Only Banks

Consider switching to digital-only banks or fintech solutions like N26, Revolut, or Wise. These platforms often offer lower fees, better exchange rates, and more transparent pricing compared to traditional banks. - Compare Bank Fees

Regularly compare the fees charged by different banks for services such as account maintenance, ATM withdrawals, and international transactions. - Use Fee-Free ATMs – Whenever possible, use ATMs that do not charge withdrawal fees. Some digital banks offer free ATM withdrawals up to a certain limit each month.

- Monitor Exchange Rates – If you frequently transfer money abroad, keep an eye on exchange rates and choose providers that offer competitive rates without hidden fees. Digital banks and fintech solutions often provide better rates than traditional banks.

- Leverage Financial Apps – Use financial apps to track your spending, set budgets, and manage your finances more efficiently.

- Stay Informed – Stay informed about changes in banking regulations and new financial products that could benefit you. Follow financial news and updates from reliable sources to make informed decisions.

- Provide Feedback – If you’re unhappy with your bank’s fees or services, provide feedback to your bank and consider switching to a provider that better meets your needs. Consumer feedback can drive positive changes in the banking industry.

By taking these steps, you can minimize the impact of high bank fees and make more informed financial decisions.