Best Rewards Credit Cards in Ireland - November 2024

Owning a reward credit card is a great way of making the most of your spending in categories that suit your lifestyle. Banks or credit card providers offer rewards in two ways, through cash back cards or travel cards. Cash back credit cards are the simplest and most common form of rewards. It pays you back a set amount or percentage of amount on each approved transaction. Travel credit cards offer frequent travellers points or miles when they spend on their cards. it also offers free flights, lounge access, hotel stays and more. Whether you are looking to make a purchase in a particular category or you are a frequent traveller, here are some of the credit cards in Ireland that may help you reach your goal.

Best Rewards Credit Cards in Ireland

- AIB Platinum Visa Card: Best for no annual fee

- Bank of Ireland AER Credit Card: Best for travel rewards

- Avant Money Reward+ Card: Best for long term value

- Bank of Ireland Affinity Credit Card: Best cobrand with donations

Snapshot of Irelands Best Rewards Credit Cards

Compare the Best Rewards Credit Cards

Best Credit Card For No Annual Fee

AIB Platinum Visa Card

- Monthly Fee: €0

- Intro Offer: 3.83% variable on purchases and balance transfer for 12 months

- Interest Rate: 11.84% variable on all purchases

- APR: 17% variable

- Currency Conversion Fee (POS/ATM): 1.75% (Europe) and 2.75% (other region)

- Stamp Duty: €30 annually

- Balance Transfer: 3.83% variable for 12 months

- Additional Card Fee: €0

- Late Payment Fee: €7

- Cash Advance Fee: 1.5%

Currency

EUR

Multi currency

No

Segment

Premium

Scheme

Visa

Co-branded

No

Income Requirement

€40,000

Best Credit Card For Travel Rewards

AER Credit Card

- Annual Fee: €78

- Intro Offer: 0% on all purchases and balance transfers for 7 months

- Interest Rate: 16.12% variable on all purchases

- APR: 22.7% variable

- Currency Conversion Fee (POS/ATM): 2.25%

- Stamp Duty: €30 annually

- Balance Transfer: 27%

- Additional Card Fee: €0

- Late Payment Fee: €7.50

- Cash Advance Fee: 1.5%

Currency

EUR

Multi currency

No

Segment

Standard

Scheme

Mastercard

Co-branded

AER Lingus

Income Requirement

€16,000

Best Credit Card For Long Term Value

Avant Money Reward + Credit Card

- Monthly Fee: €0

- Intro Offer: €100 Cash back credited to your account. 25% interest refund every month.

- Interest Rate: 16.8% variable on all purchases

- APR: 22.9% variable

- Currency Conversion Fee (POS/ATM): 2.65%

- Stamp Duty: €30 annually

- Balance Transfer: Not applicable

- Money Transfer: Available but no offers

- Additional Card Fee: €0

- Late Payment Fee: €15.24

- Cash Advance Fee: 1.5%

Currency

EUR

Multi currency

No

Segment

Standard

Scheme

Mastercard

Co-branded

No

Income Requirement

Not stated

Best Credit Cards For Cobrands With Donations

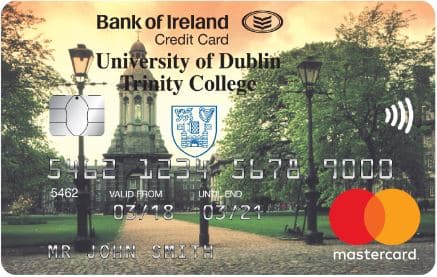

Affinity Credit Card

- Monthly Fee: €0

- Intro Offer: 2.9% fixed interest rate on balance transfers for 12 months

- Interest Rate: 14.57% variable on all purchases

- APR: 20.2% variable

- Currency Conversion Fee (POS/ATM): 2.25%

- Stamp Duty: €30 annually

- Balance Transfer: 2.9% on balance transfers for 12months

- Additional Card Fee: €0

- Late Payment Fee: €7.50

- Cash Advance Fee: 1.5%

Currency

EUR

Multi currency

No

Segment

Standard

Scheme

Mastercard

Co-branded

Yes

Income Requirement

€16,000

Types of Reward Credit Cards

Rewards credit cards generally caters to 2 types of spending, everyday spending or travel spending. All rewards credit cards offers rewards in the form of cash back, points or miles. Cash back rewards are tailored to everyday spending and is a great choice if you prefer flexibility in your spending and you just want a straight forward and simple cash credit back to you when you spend. Travel rewards are tailored to travel spending, where you get awarded points and its a great choice for you if you enjoy the thrill of redeeming points to snatch up a great deal. As a frequent flyer with Aer Lingus, cobranded credit card like AER Credit Card with Bank of Ireland will likely work in your favour. . Understanding different types of rewards credit card and how they work is important in making a credit card choice. To get maximum value from your credit card, you will need to evaluate the credit card provider rewards program, know your spending habits and check to see if its matches or aligns with the structure and rewards of the card.

Pros and Cons of Rewards Credit Cards

Pros

- Earning rewards on your everyday spending and every little savings adds up.

- Travel perks that come with credit cards are worth it. Features like airport lounge access, travel insurance, access to luxury hotel discounts and flight cancelation or delay compensation are great benefits that some rewards offer.

- Rewards credit cards offer intro APRs or 0% interest rates that help you pay off existing credit card debts balances or pay down large purchases.

Cons

- Rewards cards with intro offers sometimes have a high APR which makes the credit card expensive to keep over a long time. Reward cards are best to use for their rewards for purchases and pay off in full when your statement comes. If you tend not to pay off your credit card balance each month, then higher APRs can cancel out any rewards you may earn.

- Most rewards come with annual fees, you have to ensure that your reward earnings on the card outweighs the annual fees you pay.

- Spending on rewards card can be complex and require some kind of mental calculations of where and when to use the card and get rewards. Some people may not be able to keep up.

Who Should Get a Rewards Credit Card?

Rewards credit cards are best for the following people

- Good Credit History and who pay off their credit balances each month.

- Frequent Travellers

- Shoppers

- Food lovers

How to Choose a Reward Credit Card?

- The first step to choosing a rewards credit card is to decide the type of rewards you want.

- Understand the perks and rewards on the credit card of your choice and choose the card that offers the best possible earning potential for you.

- Consider the fees, such as annual fees, foreign transaction fees or late payment fees. Most credit cards in Ireland don’t charge an annual fee but if the card comes with an annual fee and how much does it cost, and does the reward outweigh the cost of the card.

- Is there a welcome offer, this may come in like the Avant money reward + with 100 cash back, check if it is the best offer in the market.

- Some rewards credit cards offer 0% intro interest rates that lasts anywhere from 3 to 12 months which will help you finance large purchases or pay off credit card balances without paying more interest.

- Consider the interest rates on the card after the offer period. Average APR in Ireland is 21% and this varies depending on the provider and your credit profile. Howeverto avoid paying interest. you have to prioritize paying off your credit balance in full. Carrying outstanding debt balances will offset any reward value that the card offers.

How do Rewards Credit Cards Work?

How cash back rewards work

Right now we have only 2 – 3 cash back cards in Irelands. With a cash-back credit card you’ll be rewarded with a percentage of your purchases paid back to you as a statement credit to your account. Like AIB platinum visa card, you earn cash back rewards of 0.5 % of the amount you spend. Cash-back rate is 0.5% which is 0.5 cents per euro spent. Some cash back credit cards just offer a one off . Like the affinity credit cards, when you become a credit card holder, the bank of Ireland gives back to your alumni school up to €50. Your monthly statement will normally show you the rewards you’ve earned to date.

How travel rewards work

Travel rewards credit card offer points or miles when you use the card, but you can often earn different points in different categories. Other perks of travel rewards card, include fast track and priority boarding, lounge access, return flights and travel insurance benefits. For example we have just one travel credit card at the moment in Ireland which is the AER Credit Card which offers Avios points on travel spending and more rewards on top, Aer credit card is an airline specific and cobranded credit card. The rewards are specific to Aer Lingus and most rewards are to be used only with the brand. However there are other general – purpose travel cards that are not tied to an airline brand. These types of credit card are not popular in Ireland

Alternative Credit Cards to Consider

There are other credit card categories that are valuable and may be worth checking out.

- Best cash-back credit cards

- Best travel credit cards

- Best premium credit cards

- Best low interest credit cards

- Best student credit cards

- Best 0% interest rate purchases credit cards

- Best money transfer credit cards

- Best balance transfer credit cards

Review Methodology

Coins to Asset reviews credit card across many the factors. We analysed popular 14 credit cards available in Ireland to come up with the best cards for you. We looked at fees, interest rates, rewards and cash backs including the ease of redeeming the rewards. We also considered the monetary value of the benefits and perks and the overall value add of the card to the cardholder. Part of our review includes ease of credit card application, the simple reward structure, attractiveness of the features, and whether the card suits everyday use or best reserved for specific purchases. We give star ratings serve as a general guide of our comparison but it is only a consideration when you are choosing a credit card not a rule. Learn how Coins to Asset Rates Credit Cards.

Frequently Asked Questions

Lynda Unogu MBA IMC (CFA UK) PMP

Lynda holds an MBA from University College Dublin and worked previously in product roles within financial services and technology firms like Mastercard, Citi Bank and JP Morgan. She constantly seeks to apply her expertise in financial services to the field of personal finance with the goal of helping people navigate the complexities of the finance.

We would love to hear about your experience on credit card rewards.