History of Credit Cards

The first recorded credit card transaction was identified over 5000 years ago in ancient Mesopotamia, when the ancient civilization of Mesopotamia used clay tablets to trade with their Harappan neighbours. This way of payments has evolved and paved way for innovations in commercial trade.

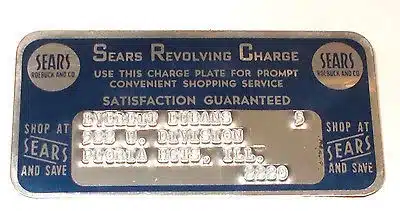

The credit cards we are familiar with today were first issued in America by hotels at the beginning of the century. Around 1885, loyal customers of hotels and department stores received what can be considered early paper store credit cards.. By 1914, large department stores like Western Union and gas station chains were issuing cards to their customers to allow them to defer payment or to finance their gas and repair services at their stations. Although it slowed down during the two World Wars and by the Great Depression. In 1950s things kicked off and third party cards began, first as travel and entertainment cards and then as bankcards. During the 1960’s the BankAmericard, now Visa, and the Master Charge systems now Mastercard, eliminated competition and established as main credit card network.

In short, credit cards has been around before World War II. Big department stores, oil companies, hotel franchises and airlines have been using credit cards as a tool attract and bind customers.

We will go through step by step how credit cards have transformed through the years.

The Ancient Credit Tablet - 5000 Years Ago

Over 5,000 years ago, long before currency existed, ancient Mesopotamia introduced the clay tablet as a way for traders to buy now, pay later. the use of clay tablets and inscribed shells as a substitute for real money. The tablet was also used to record transactions, count and record keeping. Debtors records are recorded and can be wiped clean when settled or to protect debtors.

The Credit Coins - Early 1900s

Credit coins were issued soon after the Civil War in the early 1900s. They were issued by merchants such as department stores, taxi companies and other retailers as a form of payment. The coins featured the name of the company and stamped with an image and a three or four digit account number that would identify the consumer. When the purchaser used the coin for payment, the merchant would look up the paper file linked to the account number to review the credit limit and authorize it. In general, these tokens have no specific monetary value; instead, they were linked to a billable account that is paid monthly. (If you lost a token, you were required to announce its loss in a newspaper advertisement.)

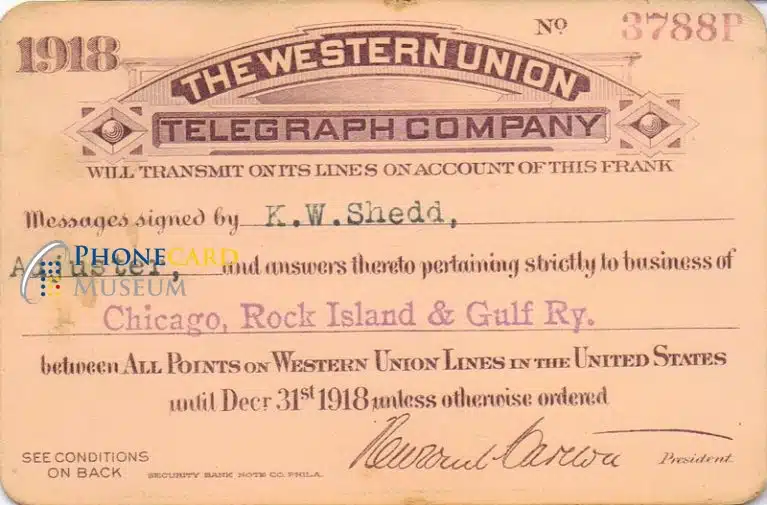

The Western Union Metal Money - 1914

Western Union got started by offering customers reliable money transfers between New York, Boston and Chicago. In 1914, Western Union introduced metal cards called metal money, which lets customers defer paying for Western Union services.

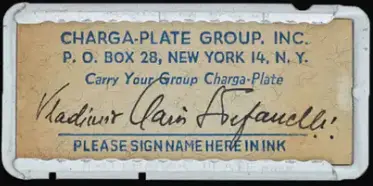

The Charger Plate Bookeeping System - 1928

Charga-Plate were the first iteration of store credit cards. The dog-tag style metal card, popularised by Charga-plate bookkeeping system was developed in 1928 and used for 20 years up to 1950s by department stores such as Bloomingdale’s Arnold Constable, Saks, Franklin Simon and Gimbels. These stores each issued their own store plates to their customers for use at any of the cooperating stores.

The Charge it System - 1948

In 1946, John Biggins created the first bank-issued card called Charg-It, but it was only valid at merchants or multiple vendors within a two block radius of his bank. When a customer used it to make a purchase, the bill was forwarded to Biggins’ bank. The bank reimbursed the merchant and obtained payment from the customer.

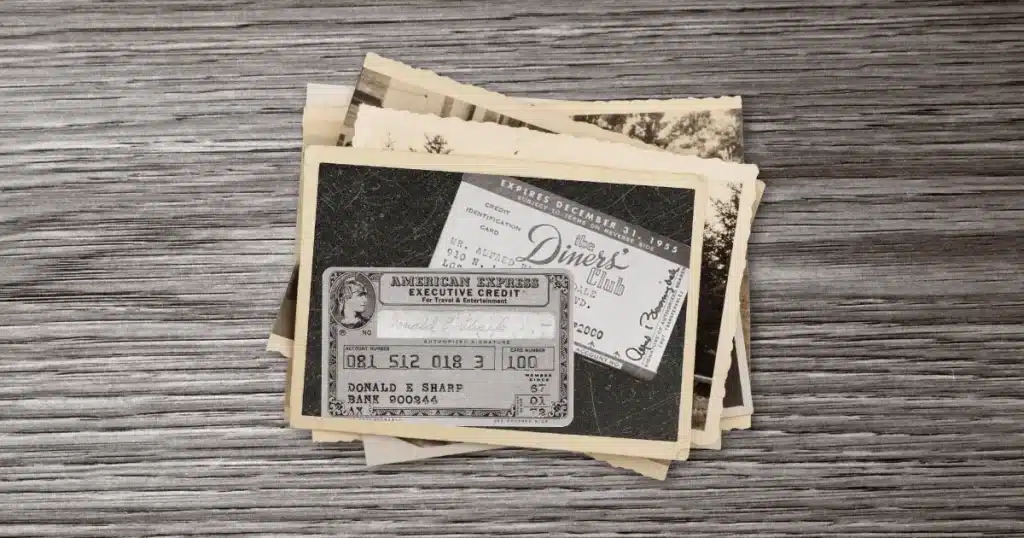

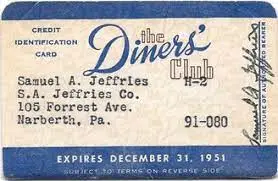

First Diners Club Card - 1950

Diners Club was the next step in credit cards. Frank McNamara and business partner Ralph Schneider introduced the first diners club in 1950. It was the first charge card to gain widespread popularity. Diners Club was the first that could be used both at different branches and companies across a broad geography. Diner’s Club was launched with a $1.5 million investment, and its initial paper cards offering were accepted at 27 New York City restaurants by roughly 200 friends but both the merchant and subscriber base grew rapidly thereafter, with annual fee paying subscribers going from 200 to 43,000 within a year. By 1953 the card was being accepted in the UK, Canada, Cuba, and Mexico. Users were required to pay their full bill at the end of the month in order to continue using them. Diners Club offered its first plastic credit card in 1961 and surpassed 1 million members in the early 60’s. The company was acquired by Citigroup in 1981 and Discover Financial Services in 2008. They established their credit cards as a Travel & Entertainment (T&E) loyalty card.

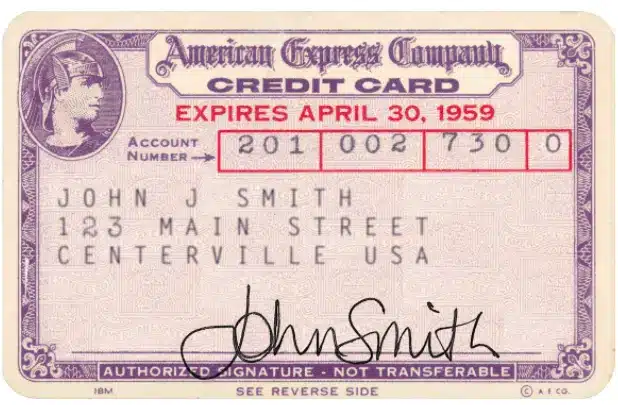

American Express First Charge Card - 1958

Diners Club Card was followed by American Express in 1958, who were the first to issue embossed plastic cards in 1959. Today, Diners Club and American Express are still the pioneers in the travel & entertainment space in cards business.

The Diners Club and American Express cards had a ‘closed-loop’ model system. This is made up of the consumer, the merchant and the issuer of the card. In this system they charged their customers an annual fee for using the card and billed them monthly. They also charged merchants, or companies, fees to accept the credit cards as payment. These service fees averaged 4-7% of the total amount charged.

Bank Americard - 1959

The next was Bank of America’s Bank Americard introduced in 1959, which went beyond travel and entertainment. Bank of America invented credit card mass-mailing and dispersed over 2 million cards used at over 20,000 merchants across San Francisco, Sacramento and Los Angeles. In 1958, Bank of America began offering cards on a state-by-state basis, meaning that the cards could only be used in the state issuing the card. This evolved into a national system allowing individuals to make a purchase anywhere, regardless of the location. The general-purpose credit card was licensed to other banks from 1966. Bank of America established the BankAmerica Service Corporation that franchised the Bank American brand to banks nationwide. The Corporation became Visa in 1977. Eventually the effort grew into an international system and is now available all over the world.

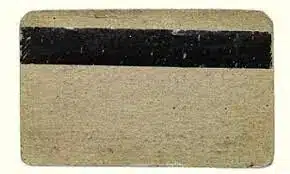

First Magnetic Stripe Credit Card - 1960s

In 1960s IBM engineer Forrest Parry invented the first magnetic stripe credit card. This magnetic strip technology introduced a swift computerisation of information processing. It later became standard in the US in 1969 and worldwide two years later. In the 1980’s, magnetic strips were placed on the back of cards which allowed special computer equipment to read the card and process the transaction. Since then, credit cards have evolved. Cards now use embedded computer chips, called EMV smart chips, that allow for data to be encrypted each time the card is used.

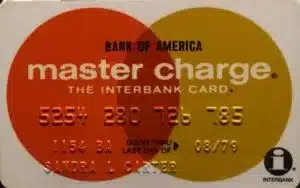

Master Charge Card/Master Card - 1966

ICA – Interbank Card Association was formed by several regional banks to create the Master Charge card to compete with Bank Americard. In 1966, Barclays Bank became the first in England with its Barclay Card, and in 1967, four California banks came together to offer the Master Charge card, which became MasterCard from 1979. The ICA is now known as MasterCard Worldwide, though it was temporarily known as Master Charge. This organization competes directly with a similar Visa program. The new bank card associations were different from their predecessors in that an ‘open-loop’ system was now created, requiring interbank cooperation and funds transfers Visa and MasterCard still maintain “open-loop” systems, whereas American Express, Diners Club and Discover Card remain “closed-loop.” Visa and MasterCard’s organizations both issue credit cards through member banks and set and maintain the rules for processing. They are both run by board members who are mostly high-level executives from their member banking organizations. As the bank card industry grew, banks interested in issuing cards became members of either the Visa association or MasterCard association. Visa and MasterCard developed rules and standardized procedures for handling the bank card paper flow in order to reduce fraud and misuse of cards. The two associations also created international processing systems to handle the exchange of money and information and established an arbitration procedure to settle disputes between members.

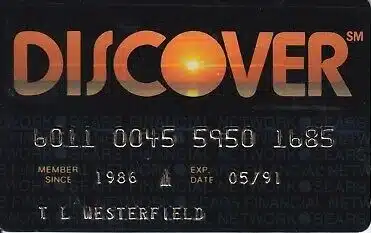

Discover Card

Sears introduces Discover Card. Discover Card Services sought to create a new brand with its own merchant network, and the company has been successful at developing merchant acceptance. .

American Express Credit Card Loyalty Program -1987

Although American Express was among the first companies to issue a charge card, it wasn’t until 1987 that it issued a credit card allowing customers to pay over time rather than at the end of every month. Its original business model focused on the travel and entertainment charges made by business people, which involved significant revenue from merchants and annual membership fees from customers. American Express launches the first credit card loyalty program originally called membership miles now known as membership rewards

History of Credit Cards - Technology

Credit Card Technologies

Magnetic Strip – This was a major breakthrough in credit card technology in the 1960s and a catalyst in promoting credit cards as a payment method. An IBM engineer named Forrest Parry is credited with affixing magnetic tape to the back of cards so that consumers could have their information “swiped” at a point-of-sale terminal. Magnetic tape was originally used to store audio information and Parry was tinkering with ways to have it contain cardholder information to put on a credit card. With technological advances come those who try to exploit them. As credit cards gained in popularity, so did the swindlers who used their own methods to make false charges using others’ card information. The easy access of swiping a card meant thieves could use a card they found or stole. More sophisticated fraudsters developed a process known as “skimming” where a thief could skim the information with their own reader to steal the cardholder’s information. Although magnetic credit cards were a game changer, they posed security issues, The information stored in the magnetic stripe could be copied and signatures used as a form of identity verification could be forged.

EMV Chip – A safer technology was developed in France in 1984 when microprocessors were embedded into cards that could be read by specialized payment terminals. The need for a standardized payment system became a global issue and in 1994 three international payment processors, Europay, MasterCard and Visa began the development of a global chip specification for payment systems.. By 1994, all credit and debit cards in France employed this technology which, combined with a PIN, or personal identification number, added extra layers of protection to the payment process. Chip technology offered additional layers of security, making fraudulent charges harder to pull off. Most credit cards in the US are now issued with EMV chips. When paired with a PIN instead of a signature, the likelihood of fraud is further reduced. Soon other countries developed their own credit card chip systems, but since the card readers were not interchangeable it means someone traveling to another country would have to have their card swiped instead of having the chip read.

NFC Technology – By 1996, the first specifications for EMV chips were released, with subsequent versions released afterwards. The most significant advance in the credit card chip industry came with the advent of contactless payment systems where a credit card’s chip could be read by holding it near to an enabled payment terminal. This could be done with Near Field Communication (NFC), a type of radio frequency that was used so that a card’s chip and the point-of-sale terminal could “talk” to each other. Eventually, card information could be stored in smartphones and wearable devices and read by terminals using the same NFC technology.

Contactless credit cards: The first contactless credit cards in the US were used in 2004. This method for payment became more popular in 2008 and beyond as Visa, Mastercard and American Express all started offering their own contactless cards. Mastercard’s tiny Side Card was released in 2003 and also incorporated new technology that allowed cardholders to simply hover the card over contactless payment terminals, and just like that, a transaction would be complete. More recently, wearables, such as watches, wristbands, and even rings, have entered the contactless credit card payment space, too.

Mobile wallets: The problem with a credit card is that even if it has a chip and requires a PIN, if someone else has the card, they could find a way to use it. Looking to make purchases more secure and convenient, Google introduced the first mobile wallet that stored your credit card information in 2011. Apple followed a year later. With a mobile wallet, you can use your smartphone to pay, eliminating the chances of a lost or stolen credit card. Sure, your smartphone could go missing too. But the security built into using phones — such as passcodes, fingerprint recognition or facial recognition — are designed to make it hard for someone to use your virtual credit card. Mobile wallets emerged in 2008, shortly after the dawn of smartphones when Apple opened its App Store. In May 2011, Google Wallet led the way for apps that stored payment card information for use in place of a physical card. With little bank and retailer participation at first, Google Wallet and competitors such as CurrentC and Softcard struggled to earn consumer adoption. Apple Pay launched in October 2014 with 220,000 merchants ready to accept wallet payments at launch

Final Thoughts

From clay tablets to plastic cards, the credit and credit card system has really evolved but credit cards are here to stay. The physical cards are being gradually phased away while mobile wallets and virtual credit cards are increasingly adopted. Biometrics, selfies, retina scans and fingerprints are the future of credit payments.